Feature

Candidate Sourcing

Find top talent from multiple sources like job boards, social media, and referrals, all in one place.

Job Advertising

Post job openings on leading job portals and platforms to reach a wider audience and attract qualified candidates.

Careers Site

Create a branded careers page to showcase job openings and company culture, attracting the right candidates.

Source Boosters

Enhance candidate sourcing with advanced tools to find the best talent from untapped sources.

Social Recruiting

Manage employee queries and HR-related cases efficiently with an organized ticketing system for faster resolution.

Employee Referral

Set up an employee referral program to encourage your team to recommend top talent from their networks.

Hiring Pipeline

Track candidates through each stage of the hiring process with a clear and customizable pipeline.

Resume Management

Organize and manage candidate resumes easily, ensuring you never lose track of qualified candidates.

Manage Submissions

Streamline the process of reviewing and managing candidate submissions from various sources.

Background Screening

Conduct background checks to verify candidates' credentials, ensuring you hire trustworthy talent.

Hiring Analytics

Gain insights into your recruitment performance with analytics, helping you refine your hiring strategy.

Assessments

Evaluate candidate skills and competencies with custom assessments tailored to job requirements.

Video Interview

Conduct remote interviews via video, saving time and ensuring faster candidate evaluation.

Blueprint

Automate and standardize the recruitment process with workflows that ensure consistent hiring practices.

AI Recruitment

Use AI-powered tools to match candidates with job requirements, helping you make smarter hiring decisions.

Offer Letter

Create, send, and manage offer letters digitally to streamline the final step of the hiring process.

Onboarding

Ensure smooth onboarding for new hires with tools that simplify paperwork and integrate them into the team seamlessly.

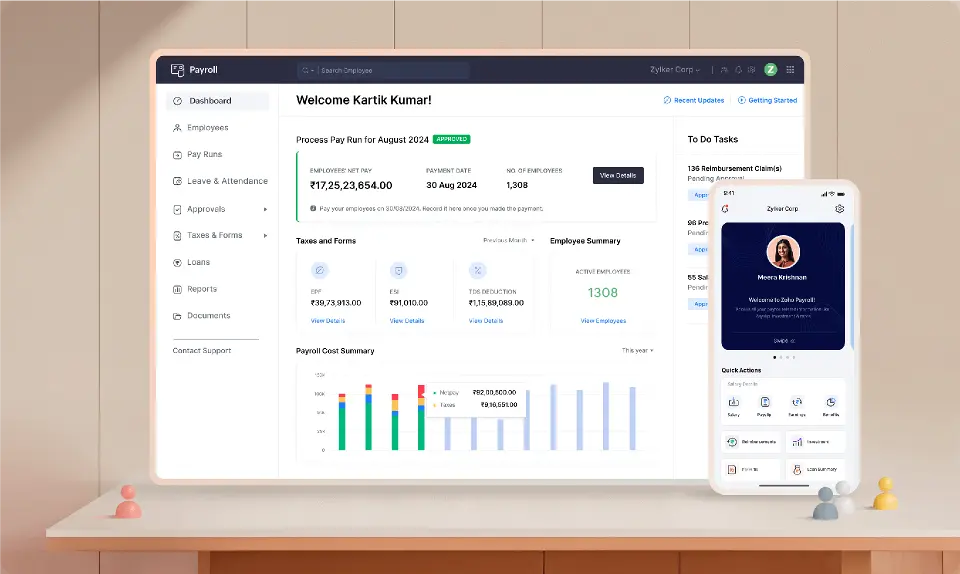

Explore What Zoho Payroll is All About!

Discover how Zoho Payroll can simplify your payroll processes, ensure compliance, and enhance employee satisfaction—all in one powerful platform.

Pricing and Feature

FAQ

We're here to answer all your questions.

If you're new to OvertNexus or aiming to enhance your current setup, this section will introduce you to our platform and its robust features. Whether you're just beginning or seeking to optimize your existing stack

Yes, Zoho Payroll ensures compliance with statutory laws, including income tax, Provident Fund (PF), Employee State Insurance (ESI), and professional tax.

Zoho Payroll allows you to process employee salaries directly into their bank accounts, with detailed payslips generated for each payroll cycle.

Yes, Zoho Payroll integrates with Zoho People, Zoho Books, and Zoho Expense for unified HR, accounting, and expense management.

Yes, Zoho Payroll is designed to meet the needs of small and medium-sized businesses, offering flexible pricing plans and scalability.

Got any more questions?

Get in touch